Is amazon flex 1099.

Make quicker progress toward your goals by driving and earning with Amazon Flex.

There is a system error. Please try again later. ...Content provided for general information. Talk to your advisor to confirm the details for your specific situation before taking action.If you drive for Amazon Flex, you’re responsible for setting aside and reporting your own taxes. It’s easy to do if you take the time to learn the basics. Here’s how...Getting your 1099 form from Amazon Flex is an important step in filing your taxes as an independent contractor or freelancer. By following the steps outlined in this article and keeping accurate records throughout the year, you can ensure that your taxes are filed correctly and that you’re taking advantage of all of the deductions and credits …AMAZON FLEX VISA ® DEBIT CARD OFFERED ... You also understand that Amazon may issue an IRS Form 1099 indicating the approximate retail value of certain …

Sometimes, the Amazon Flex pay can be as high as $55/hour during peak season or extreme weather. That’s called surge pay. ... Therefore, you have to pay your taxes. You will receive 1099 tax information to use on your tax return. When Can Amazon Flex Deactivate Your Account? Below are several reasons why Amazon Flex could …Blue Summit Supplies 1099 NEC Tax Forms 2022, 25 5 Part Tax Forms Kit, Compatible with QuickBooks and Accounting Software, 25 Pack. 4.5 4. ... Shop products from small business brands sold in Amazon’s store. Discover more about the small businesses partnering with Amazon and Amazon’s commitment to empowering them. Learn more. 2022 1099 INT ...

You can choose to do this once your amazon flex earnings go over £1,000 during a tax year if you like by taking advantage of the £1,000 trading income allowance. The deadline for registering is the 5th October following the end of the tax year you started working as a driver or your earnings go over the £1,000 limit.AMAZON FLEX VISA ® DEBIT CARD OFFERED ... You also understand that Amazon may issue an IRS Form 1099 indicating the approximate retail value of certain Rewards to relevant taxing authorities for tax reporting purposes. Please consult your tax advisor if you have any questions about your personal tax situation.

Be the first to answer! Will having a state issued medical marijuana card allow me to be hired if test positive for THC? Asked November 10, 2021. Be the first to answer! Describe the drug test process at Amazon Flex, if there is one. Asked September 2, 2021. It is by swab of mouth. Answered September 2, 2021.As of April 2014, Flex shampoo is still produced by Revlon, although many varieties of Flex have been discontinued. Few stores carry the brand; however, it is available online at Amazon.com.In today’s fast-paced and ever-changing job market, flexibility is becoming more important than ever. With the rise of the gig economy and the increasing demand for convenience, flex delivery jobs have emerged as a viable solution to unempl...Customers. If you’re an Amazon Flex customer anxiously awaiting a package, there’s one phone number you need to know. Call 1-877-212-6150 to reach customer support regarding a pending order or pending delivery. The Amazon Flex support team is great when it comes to dealing with immediate issues regarding package deliveries.Amazon Flex typically begins to send out 1099 forms for the previous year towards the end of January (legally they must mail them out by 1/31), so keep an eye out for them in the mail! Confused by all of the terms and instructions? Not sure how to fill out Schedule C forms? Keep reading for a tutorial on the entire process! Overview

Sign in to Amazon.com using the email address and password that is currently associated with your Amazon Flex account. 2. Click or tap Your Account > Login & security.

Jul 27, 2022 · Is Amazon Flex a W2 or 1099? The drivers will receive a 1099 in January, which will show the number earned as an independent contractor, and that the company is paid to provide Amazon Flex to the driver. Also, depending on your State’s laws, you will need to pay an annual income tax on the gross amount you earn through Amazon Flex.

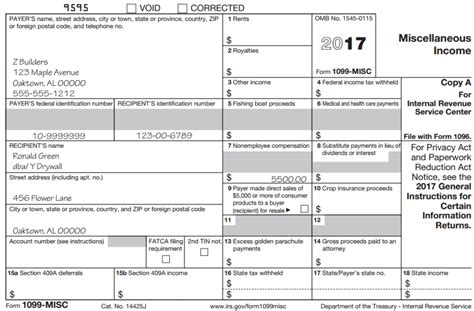

Oct 8, 2023 · It’s a progressive tax, which means that the amount of tax you’ll owe depends on your income bracket. For example, if you’re in the 24% tax bracket and earn $50,000 from Amazon Flex, you’ll owe $12,000 in federal income taxes ($50,000 x 0.24). In addition to the federal taxes that we just discussed, you’ll also need to pay state taxes. This form will have you adjust your 1099 income for the number of miles driven. In your example, you made $10,000 on your 1099 and drove 10,000 miles. $10,000*0.53=$5,300. $10,000-$5,300=$4,700. This is your business income on which you owe taxes. Understand that this has nothing to do with whether you take the standard deduction.Printing your Social Security Administration (SSA) 1099 online is a quick and easy process. This article will provide you with step-by-step instructions on how to print your SSA 1099 online.Overall, you have to weigh the risk versus rewards for using this tactic! 4. Violating Amazon Flex’s Zero Tolerance Policy. Driving jobs like Amazon Flex and DoorDash have a zero-tolerance policy for driving under the influence.. This isn’t too surprising, so if you’re caught under the influence of anything or get in trouble with the …The Amazon Flex 1099 is a tax form that Amazon provides to its delivery partners. If you’ve earned more than $600 from delivering packages with Amazon Flex, you’ll receive this form at the end of the year. This form will show how much you’ve earned and how much you’ve paid in taxes. It’s important to keep this form in a safe place ...

Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the ...Amazon Flex is a flexible side hustle that pays you to deliver packages in your free time. ... Amazon will send you a 1099 tax form stating your taxable income for the year. Current IRS rules require you to pay taxes on any self-employment income above $400. A friendly suggestion is to set aside 30% of your earnings for taxes.There are two Amazon Flex support phone numbers: (877) 212-6150 and (888) 281-6901. Make sure to save these numbers in your contacts — you’ll need them if your Amazon Flex app breaks while on a delivery. Last year Amazon sent emails to all Amazon Flex drivers stating that phone contact is only for delivery-related issues.We will issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Generally, payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive ...With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away.If you are an Amazon Flex 1099 driver, payments close attention to this strain guide. You'll debt self-employment, quarterly and income taxes for the year. In this guide, we'll go over how file and maximize your tax savings at and end of to year.4 answers. Each new offer/block has a price assigned to it, and that’s the amount you’ll receive if you accept and complete the block. A typical 3 hour block consists of delivering roughly 25-30 packages, give or take. However I’ve had as few as 4 and as many as 40. So they pretty much have a base rate for your dayshift and your evening ...

Click Start across from Miscellaneous Income, 1099-A, 1099-C. On the next screen, Let's Work on Any Miscellaneous Income, click Start across from Hobby income and expenses. Enter your information. The 1099-NEC you received from Amazon is an important document, but only you can determine how such income should be characterized.

Amazon operates a website called AmazonSmile that’s just like Amazon.com with the same products, prices and information. Amazon customers who use AmazonSmile enjoy having a choice in what charities they support — and all they have to do is ...Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.Aug 8, 2017 · 4 answers. Each new offer/block has a price assigned to it, and that’s the amount you’ll receive if you accept and complete the block. A typical 3 hour block consists of delivering roughly 25-30 packages, give or take. However I’ve had as few as 4 and as many as 40. So they pretty much have a base rate for your dayshift and your evening ... Make quicker progress toward your goals by driving and earning with Amazon Flex.If you suspect any unauthorized access on your Amazon Relay account (e.g., unauthorized account setup, password/ e-mail/ user/ phone number/ bank account change), or any account security issue, you can contact us at [email protected] does not request personal information like passwords, OTPs, and credit card numbers over phone …According to Keeper Tax, Amazon will send both you and the IRS a 1099-NEC form if you make more than $600 in a tax year. You can expect the forms by Jan. 31 of the year after the tax year in...Code 7 on Box 7 of the 1099-R tax form means Normal Distribution, states TurboTax. The normal distribution is for individuals who are older than 59-1/2, and the distribution does not have a penalty.This is the "non-employee compensation" 1099 shape you receive by Amazon Flex if you earn for least $600 with them (if it is under $600, you will not receive …Simon Paul. January 29, 2022. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. You are required to provide a bank account for direct deposit, which can take up to 5 days to process. Once your direct deposit is on its way, Amazon Flex will send you an email to let you know!

NEW: 1099 NEC Tax Form; How do I access my form on line? To access a digital copy of your form, please follow these steps: Log in to Amazon Associates ; Hover over your email address displayed in the top right corner, and select Account Settings. Scroll down to Payment and Tax Information.

Is Amazon flex independent contractor? Your 2018 IRS Form 1099-MISC is now available. To download your form electronically, follow these steps: Go to https://taxcentral.amazon.com.IMPORTANT TAX RETURN DOCUMENT NOW AVAILABLE Log in with your Amazon Flex email and password. In the "Year-end tax forms" section, click "Find Forms" Click "Download".

Amazon Flex drivers are not Amazon employees, therefore can NOT get an AT&T discount. Flex drivers work WITH Amazon not for them. Whoever is telling you this doesn't understand that Flex drivers are independent contractors. Also there is no "badge" as we are not employees. I just talked with ATnT last week….. he said flex doesn’t qualify as ...If you need your 1099 or need to update any personal information on your 1099, you will need to reach out to the platform you work for. We’ve collected this list of resources from a few of our partners. Amazon Flex. Doordash. Grubhub. Favor Delivery. Instacart. Shipt. Uber/Postmates. Please note that several of our partners use Stripe to send ...According to the North Carolina Office of the State Controller, 1099 vendors are trade and non-trade entities or individuals that provide goods, services or contract work for a company.For a side gig or part-time job, you can earn decent extra income working as an Amazon Flex driver.Dec 8, 2021. Is Amazon flex a 1099 job? Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Does Amazon Flex pay for fuel UK?Go to your phone’s My Files or Downloads folder and tap the Amazon Flex icon to install. If you use an iPhone, set up trust for the app: 1. Go to Settings > General > Profiles or Device Management. 2. Tap Amazon.com, Inc. > Trust Amazon.com, Inc. 3. …If you are an Amazon Flex 1099 driver, payments close attention to this strain guide. You'll debt self-employment, quarterly and income taxes for the year. In this guide, we'll go over how file and maximize your tax savings at and end of to year.Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be …1099 Contractor. The IRS is very strict when it comes to tax reports. That’s why it is essential to know what form you need to get in each tax season. ... Is Amazon Flex lucrative enough to become a full-time occupation? There’s no right way to answer this question, but it all depends on the individual’s needs. For example, if you have ...Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Let's take a closer look at what this means. 1099 Forms You'll Receive As An Amazon Flex Driver

Use the app to request a call: In the Amazon Flex app, tap on the question mark in the top right corner to go to the Help page. Then select “Request call from support.”. You should receive a call within 30 seconds. Call Amazon directly: You can reach support by calling (877) 212-6150 or (888) 281-6901.This means that you are self-employed and will receive a 1099 form for your tax filing. (Currently, a 1099 form will be sent for earnings over $600.) As others have suggested, use an app like Stride, MileIQ, or QuickBooks Self-Employed to keep track of your mileage. The standard mileage deduction is the best way for most 1099 filers.W-9s available to Amazon Business Customers. Amazon.com Services LLC: Used for businesses that buy products shipped and sold by Amazon. Amazon Capital Services: Used if you purchase items on credit, using Pay by Invoice. Note: Unless there is a change at your organization, for example, a change in name, TIN, or address, the W-9 doesn't …As of Oct 16, 2023, the average hourly pay for an Amazon Flex Delivery Driver in the United States is $18.78 an hour. While ZipRecruiter is seeing hourly wages as high as $28.37 and as low as $8.41, the majority of Amazon Flex Delivery Driver wages currently range between $15.87 (25th percentile) to $20.43 (75th percentile) across the United ...Instagram:https://instagram. spirit halloween hanging props__990420fenben lab fenbendazole 222 mgtaliya y gustavo onlyfans This means that you are self-employed and will receive a 1099 form for your tax filing. (Currently, a 1099 form will be sent for earnings over $600.) As others have suggested, use an app like Stride, MileIQ, or QuickBooks Self-Employed to keep track of your mileage. The standard mileage deduction is the best way for most 1099 filers. airika cal onlyfanscoomer party github Amazon Flex offers both a W2 and a 1099 form to its drivers. Drivers who choose to work for Amazon Flex are classified as independent contractors and will receive a 1099 form at the end of the year for income taxes.This is the "non-employee compensation" 1099 shape you receive by Amazon Flex if you earn for least $600 with them (if it is under $600, you will not receive … nearest ross dress for less near me Note: At the end of 2023, a new US tax reporting law will take effect and require Amazon to send out 1099-Ks to sellers who made $600 in sales with no transaction threshold. “For calendar tax years before 2023 (2022 tax year and earlier), Amazon is only required to issue a Form1099-K to you if you had:Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.